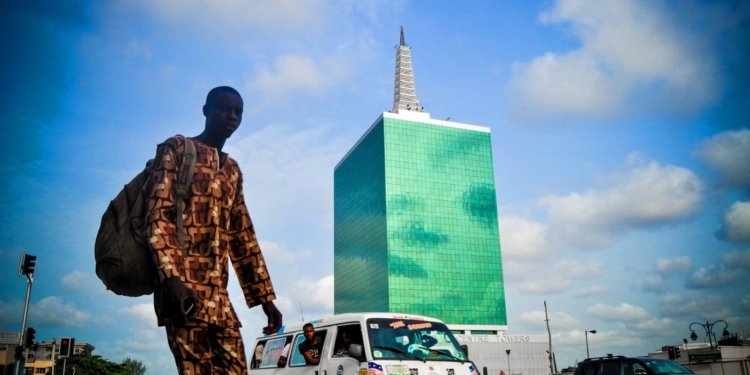

LAGOS – Nigeria’s economy grew by 3.4% in 2024, its strongest performance in more than a decade, as government reforms boosted revenue and investor confidence, according to the World Bank’s latest report.

The growth was driven by a more stable foreign exchange market, increased public revenue, and improved fiscal management, the bank said in its Nigeria Development Update.

Gross domestic product, or GDP, rose 4.6% year-on-year in the final quarter of 2024, lifting annual growth to its highest level since 2014.

Nigeria also strengthened its public finances by reducing the fiscal deficit from 5.4% of GDP in 2023 to 3.0% in 2024, supported by a sharp rise in revenue. Government income increased from ₦16.8 trillion (about $19.5 billion) to an estimated ₦31.9 trillion (around $37.1 billion).

The report emphasizes the need for structural reforms to consolidate stability and drive inclusive growth through job creation and poverty reduction.

In a significant development, Nigeria has repaid a $3.4 billion emergency loan borrowed from the International Monetary Fund (IMF) in 2020 under the Rapid Financing Instrument.

This repayment marks a milestone for Africa’s fourth-largest economy. However, the IMF noted that a $30 million annual service fee remains outstanding, underlining Nigeria’s ongoing financial obligations.

Debt Repayment and Public Perception

Baba Yunus Muhammad, president of the Africa Islamic Economic Forum, told Bantu Gazette in an interview that the repayment of IMF debt could positively influence the lives of ordinary Nigerians, but only over time and with careful management.

“In the short term, it signals fiscal discipline, which can boost investor confidence and stabilize the exchange rate, potentially easing inflation and the cost of living,” he said.

“Over time, reduced debt servicing creates room for public investment in sectors like health, education, and infrastructure, which could enhance job creation and service delivery,” he said, emphasizing that these benefits depend on transparent, inclusive policies and effective governance.

Muhammad added that settling the IMF loan strengthens Nigeria’s financial credibility and improves credit ratings. “It lowers the debt burden, allows for greater policy independence, and opens up fiscal space for development spending,” he said.

Speaking to Bantu Gazette, Agemo Olubukola Miriam, a Nigerian trade policy analyst and director of government affairs at the Badagry Chamber of Commerce, noted that while the IMF repayment is notable, the country’s broader debt profile is still concerning.

“As of the first quarter of 2024, Nigeria’s total public debt stood at ₦121.67 trillion ($91 billion), with external debt accounting for ₦56.02 trillion ($42 billion),” she said. “While the IMF chapter might be closing, other financial obligations remain a pressing challenge.”

She warned that the celebration around the IMF loan repayment could overshadow the deeper issue of how borrowing affects everyday Nigerians. “Borrowing isn’t inherently bad.”

“The problem is when loans are used mainly for consumption rather than investments that spur growth, like infrastructure or healthcare,” she said. “Much of Nigeria’s borrowing fills immediate fiscal gaps, making the country vulnerable to shocks and high debt servicing costs that divert funds from social programs.”

Miriam called for a strategic shift toward borrowing for production and sustainable development.

She referenced conversations from the recent AU debt conference, which emphasized the importance of channeling debt into long-term investments that create jobs and diversify economies.

“The Nigerian experience is a lesson in the complexities of modern sovereign debt,” she said. “Paying off the IMF is a step, but it’s far from the finish line.”

Voices from the Ground

While economists and analysts debate fiscal gains and development strategies, some Nigerians remain skeptical of the government’s narrative.

Kingsley Tochukwu, a Lagos-based inspection engineer, described the recent IMF repayment and the World Bank’s report on the country’s economic growth as a political “game.”

In a conversation with Bantu Gazette, Tochukwu stated that the daily realities faced by Nigerians contradict the official narrative of optimism.

“Inflation is on the rise. Life is becoming increasingly difficult by the day. Unemployment is alarming, infrastructure is crumbling, and the cost of living is skyrocketing. People are dying steadily as a result,” he said.

According to the World Bank report, inflation remains high, though expected to average 22.1% in 2025.

He expressed frustration over what he sees as a lack of practical measures to address the economic strain. “Nigeria needs serious, genuine intervention,” he added.

Tochukwu said that there are no visible support measures in place to mitigate the impact on ordinary Nigerians.

World Bank Urges Shift to Investment-Friendly Growth Strategy

The World Bank’s latest report emphasizes the need for Nigeria to accelerate economic growth and reorient its economy toward productive sectors capable of generating jobs and broad-based opportunities.

It recommends a private-sector-led, public-sector-facilitated growth model that focuses on closing infrastructure gaps, particularly in electricity and transportation, fostering healthy market competition, improving the overall business climate, expanding access to finance for new and existing firms, and reforming key sectors to unlock their full potential.

“Nigeria now has a historic opportunity to improve the quantity and quality of development spending, investing more in human capital, social protection, and infrastructure,” said Taimur Samad, acting World Bank country director for Nigeria.

Alex Sienaert, the World Bank’s lead economist for Nigeria, said that the public sector cannot sustainably generate growth and jobs on its own.

“A useful strategy is to position the public sector to play a dual role as a provider of essential public services, especially to build human capital and infrastructure, and as an enabler for the private sector to invest, innovate, and grow the economy,” he said.

“For these reforms and growth to matter, they must be felt in homes, markets, and the daily lives of Nigerians,” Abioye, a vendor in Nigeria’s federal capital, Abuja, told Bantu Gazette during a conversation at his roadside stall. “We are hopeful our country will rise again,” he added.