The African Growth and Opportunity Act (AGOA) has expired, marking the end of 25 years of duty-free access to the US market for 32 African countries. While discussions on renewal are ongoing, uncertainty is growing around what comes next for exporters.

The trade agreement helped drive job creation, export growth and stronger US-Africa ties.

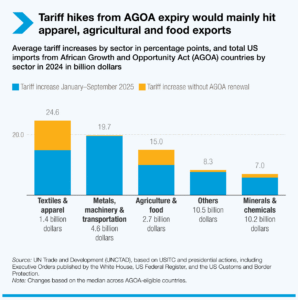

Without it, many African economies face higher duties just as they are managing additional global trade pressures.

In Lesotho, nearly 60 percent of apparel exports went to the US under AGOA.

These goods now face a 15 percent tariff, which has already led to canceled orders and job losses.

Lesotho’s textile industry employs 40,000 workers and is now struggling to compete with countries like Kenya and Eswatini that face a slightly lower rate of 10 percent.

South Africa is also under pressure. Citrus producers supporting 140,000 farm jobs now face a 30 percent tariff, the highest on the continent.

Exports of passenger vehicles to the US dropped nearly 40 percent in the second quarter of 2025.

Projections show South Africa’s overall exports to the US could fall 17 percent by 2029.

The hardest-hit industries are expected to be apparel and textiles, with exports from former AGOA countries predicted to fall 21 percent over the next four years.

Other labor-intensive sectors like leather, footwear and processed foods are also at risk.

Pamela Coke-Hamilton, executive director of the International Trade Centre, said the moment calls for action. “AGOA is about trade, not aid,” she said.

“It’s high time Africa put Africa first by strengthening regional value chains and by ensuring even the smallest of businesses have a role at the centre of this transformation,” she said in a statement on Wednesday.

She said African countries should use this moment to move beyond traditional export sectors, focus on adding value before goods leave the continent, and build stronger trade ties within Africa.