RABAT, Morocco (BG) – The African Development Bank (AfDB) Group’s Affirmative Finance Action for Women in Africa (AFAWA) initiative is supporting a $50 million financing agreement aimed at empowering Nigeria’s women-led enterprises, the bank announced in a statement on Tuesday.

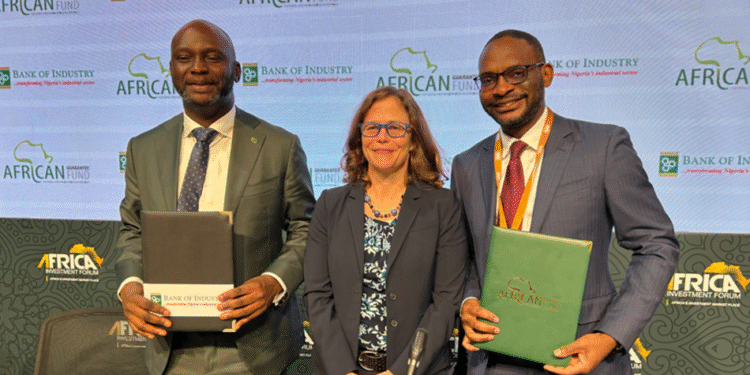

The agreement, signed between the African Guarantee Fund and the Bank of Industry during the Africa Investment Forum in Rabat on December 5, will be rolled out in three tranches over a decade.

The initiative will significantly scale up the Bank of Industry’s lending to small and medium enterprises (SMEs), particularly women-led.

The transaction is supported under the AFAWA Guarantee for Growth program, which de-risks lending and provides technical assistance to boost financing for women entrepreneurs.

“This strategic partnership illustrates the commitment of the African Development Bank, especially the Affirmative Finance Action for Women in Africa initiative, to empower women entrepreneurs and foster economic growth in Nigeria,” said Dr. Beth Dunford, AfDB Vice President for Agriculture, Human and Social Development.

The financing program features a risk-sharing mechanism to promote micro, small, and medium enterprises (MSMEs), women-owned businesses, and “green businesses” that focus on environmental sustainability and gender equity.

Jules Ngankam, CEO of the African Guarantee Fund, highlighted the transformative impact of the transaction, stating it will unlock up to $100 million in financing for Nigerian SMEs.

Bank of Industry Managing Director and CEO Dr. Olasupo Olusi emphasized the initiative’s alignment with Nigeria President Bola Tinubu’s Renewed Hope agenda, underscoring its potential to support sustainable growth, gender equity, and innovation.

AFAWA is a pan-African initiative designed to bridge the $42 billion financing gap women across Africa face. The initiative operates under three pillars: finance, technical assistance, and creating an enabling environment for women entrepreneurs.

AFAWA has recently facilitated over $2.4 billion in lending to women-led SMEs, partnering with 185 financial institutions across 44 African countries, according to the AfDB.